URD 2024

-

1.1General overview of the Group

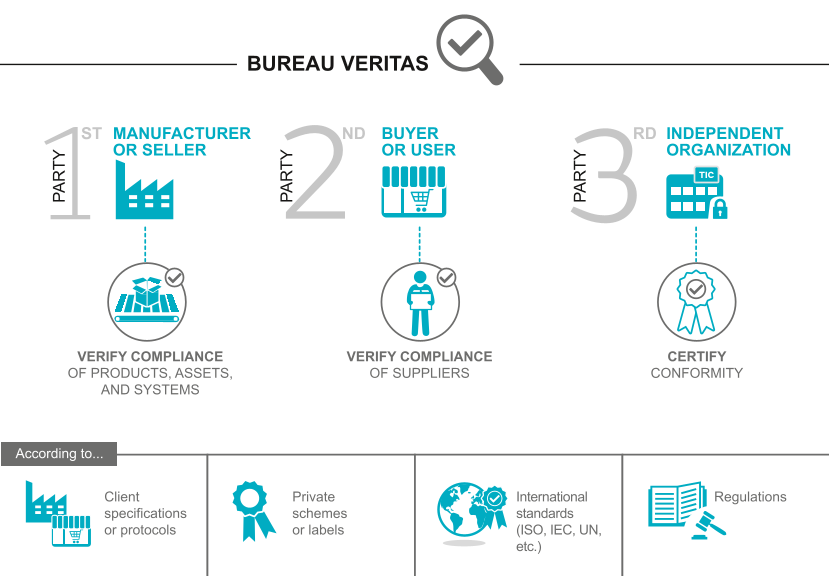

Mission

Bureau Veritas is a world leader in Testing, Inspection and Certification (TIC) services. The Group helps strengthen trust between companies, authorities and consumers. Its mission is to reduce its clients' risks and improve their performances. It also supports its clients with their innovations in the areas of quality, health, safety and sustainable development.

Bureau Veritas is recognized for its expertise, impartiality, integrity and independence, acquired over its 190 years of existence.

The services provided by Bureau Veritas are designed to ensure that products, assets and management systems conform to given standards and regulations in terms of quality, health, safety, environmental protection and social responsibility (QHSE).

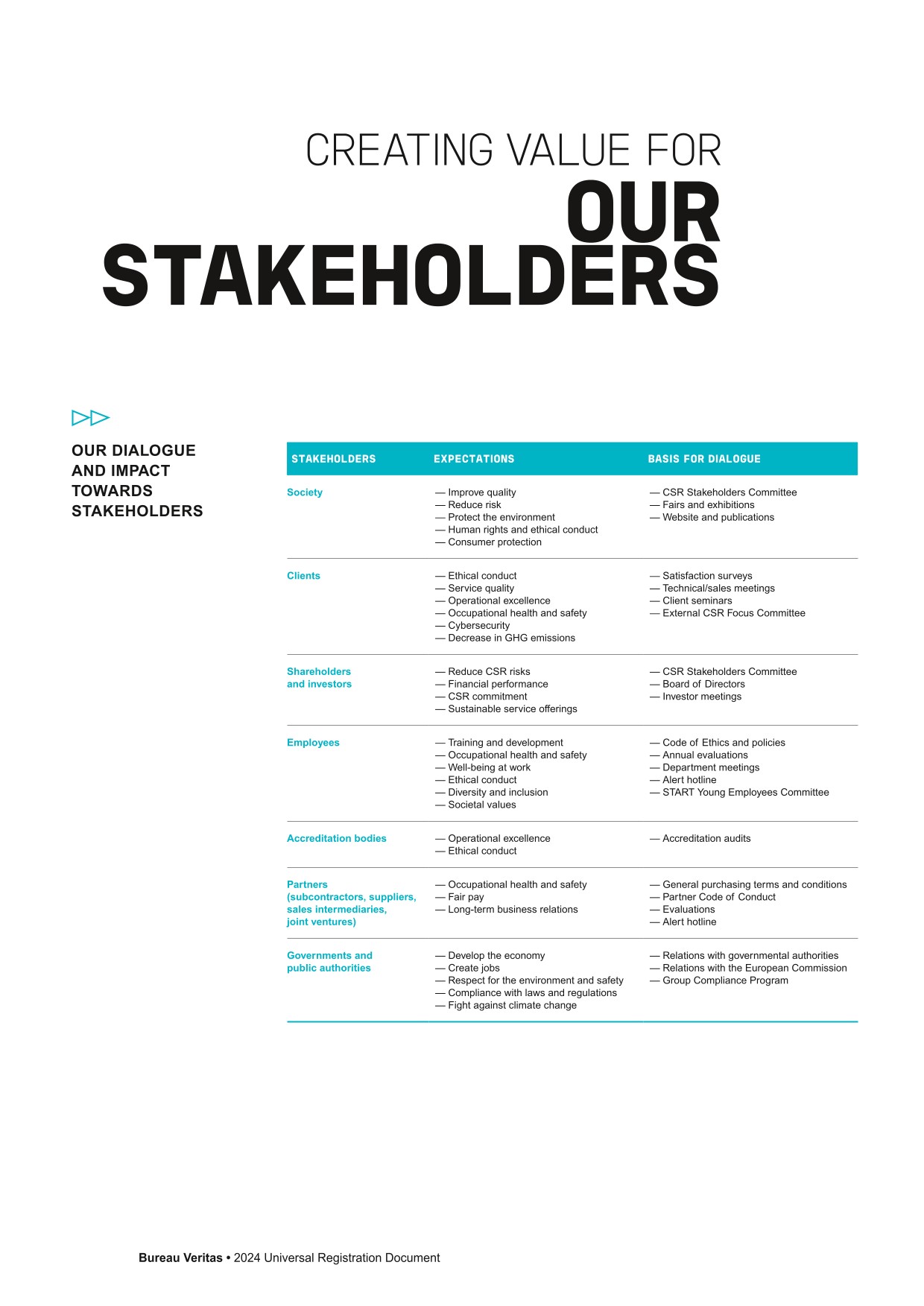

Depending on its clients' needs and on applicable regulations, standards or contractual requirements, Bureau Veritas acts:

- ●as a "third party", independently issuing reports and conformity certificates for products, assets, systems, services and organizations;

- ●as a "second party", on behalf of and upon the instructions of its clients to ensure better control of the supply chain; or

- ●as a "first party", on behalf of clients seeking support in ensuring or improving the conformity of their products, assets, systems and services.

Obtaining a license to operate

Companies must prove that they are compliant with a large number of standards and regulations. Bureau Veritas helps them by providing its in-depth expertise on the standards applicable to their businesses. As an independent third party, Bureau Veritas verifies that companies comply with these standards. This allows them to conduct and develop their businesses in compliance with local and international regulatory requirements and thereby to obtain and maintain the necessary licenses to operate issued by public authorities.

Facilitating trade

International trade relies on third-party players who certify that the goods exchanged comply with the quality and quantities stipulated in commercial contracts. Bureau Veritas plays a key role in these transactions by testing materials, verifying that goods comply with contractual specifications and validating quantities. Exchanges of commodities, for example, are based on certificates issued by companies such as Bureau Veritas.

Accessing global markets

Capital goods and mass consumer products must meet national and international standards before being sold on the market in a given country. These standards act as technical trade barriers within the meaning of the WTO. Companies design and manufacture their products and equipment in accordance with the standards of different countries. They call on Bureau Veritas to carry out tests and optimize their test plan, with the aim of getting their products to market faster.

Reducing risks

Managing risks relative to quality, health, safety, environmental protection and social responsibility improves the efficiency and performance of organizations. Bureau Veritas helps its clients to identify and manage these risks, from project design to completion and decommissioning.

Controlling costs

Second- and third-party testing, inspection and auditing methods allow companies to determine the true condition of their assets. This enables them to launch new projects and products with the assurance that costs, timing and quality are under control. During the operational phase, inspections help optimize maintenance and extend the useful life of industrial equipment.

Protecting brands

The huge rise in the use of social networks has transformed how global brands are managed. Brands may quickly find themselves impacted by a malfunction in one of the links in their supply or distribution chain. Bureau Veritas helps companies better manage these risks, by conducting analyses as a highly reputed independent global player.

-

1.2History

1828: Origins

-

1.3The TIC industry

To the Group's knowledge, there is no comprehensive report covering or dealing with the markets in which it operates. As a result, and unless otherwise stated, the information presented in this section reflects the Group's estimates, which are provided for information purposes only and do not represent official data. The Group gives no assurance that a third party using other methods to collect, analyze or compile market data would obtain the same results. The Group's competitors may also define these markets differently.

1.3.1A market estimated to be worth close to €300 billion

Services related to quality, safety, performance, sustainability and responsibility are termed as Testing, Inspection, and Certification (TIC). TIC tasks range from on-site tests and supply chain inspections to data verifications. They can be carried out at any supply chain stage, in all sectors, and by various private or public parties.

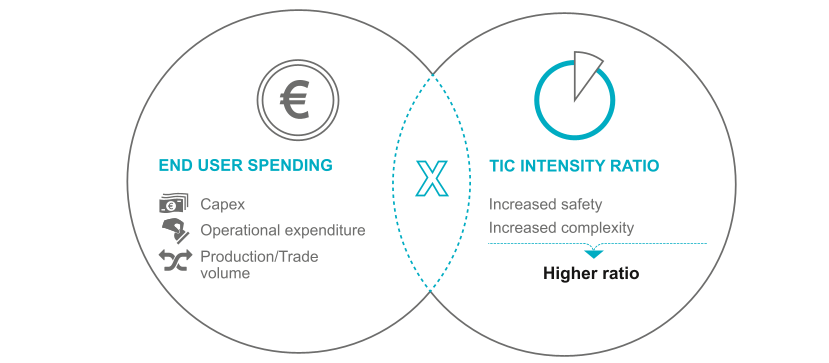

The TIC market size is tied to the value and risk of products or assets. The "TIC intensity" corresponds to the fraction of an item's value dedicated to controlling this asset or product. Typically, this fraction ranges from 0.1% to 0.8%. The TIC market's value is determined by multiplying the TIC intensity by the amount spent on goods and products by manufacturers, operators, buyers and sellers.

Market fluctuations are linked to economic factors like inflation or global economic activity and trade. Using this method, Bureau Veritas estimates the size of the global TIC market to represent almost €300 billion. This estimate takes into account external factors such as investment volume per market and the production value of goods and services.

-

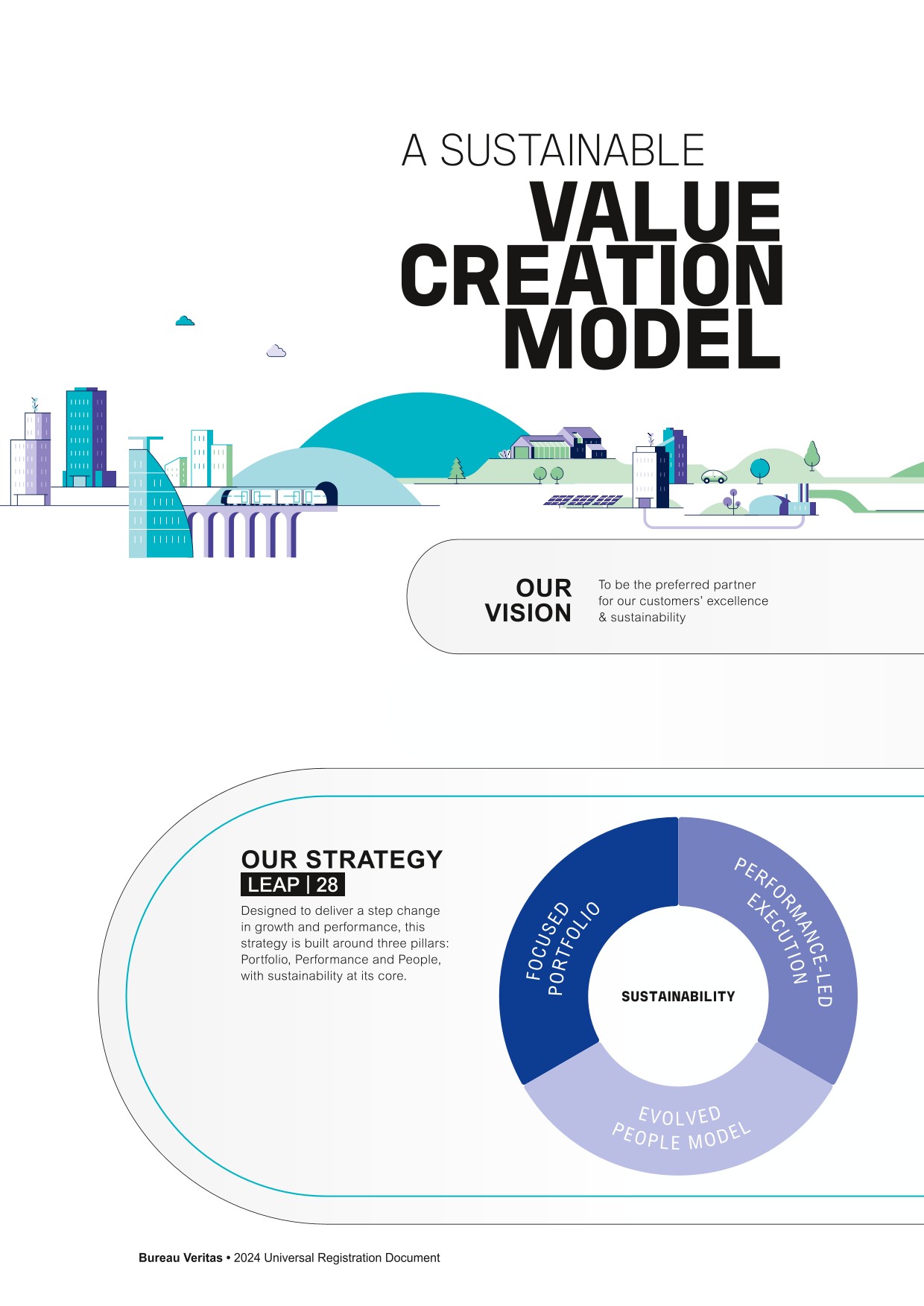

1.4Group's strategy and objectives

1.4.1Key competitive advantages

The Group benefits from an efficient international network

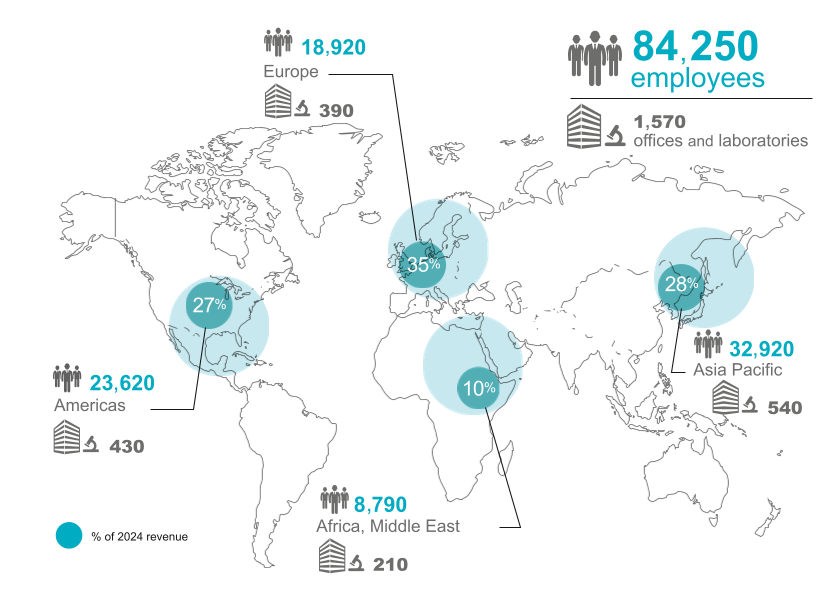

Bureau Veritas boasts a vast global network with close to 1,600 offices and labs in almost 140 countries across the world.

Countries with established economies, such as France, the US, Canada, Japan, the UK, Spain, Italy, the Netherlands, Australia, and South Korea, feature a prominent presence of Bureau Veritas. These nations have strong regulatory frameworks, and the Group is recognized for its technical prowess and modern production techniques.

In rapidly developing economies, like China, Brazil, Chile, Colombia, the United Arab Emirates, and India, Bureau Veritas has secured strong footholds for a sustainable growth. The Group has fostered a significant local presence over time in these regions and continues to grow by inaugurating new offices and labs.

The scale of the Group’s network is a core asset, offering value and differentiation at different levels:

- ●on the sales front, it allows Bureau Veritas to cater to key accounts and secure major international contracts, which represent a growing portion of its business;

- ●operationally, the Group capitalizes on its scale to enhance profitability. Economies of scale arise from shared office spaces, support functions, IT resources, and the distribution of costs associated with innovating in new services and standardizing inspection procedures over a broader base.

With a regional hub organization in pivotal countries, Bureau Veritas efficiently distributes knowledge, technical aid, and sales teams throughout areas. In the future, the Group envisions fortifying this hub-centric network structure, leveraging benefits of scale.

A strong image of technical expertise and integrity

Bureau Veritas has built a large-scale, successful global business based on its long-standing reputation for technical expertise, high quality and integrity. This reputation is one of its most valuable assets and is a competitive advantage for the Group worldwide.

Technical expertise recognized by authorities and by many accreditation bodies

Throughout its history, the Group has honed expertise across diverse technical fields and developed a comprehensive understanding of regulatory landscapes. At present, Bureau Veritas holds accreditation from numerous national and global delegating authorities and accreditation bodies, either as a second or third party. The Group persistently works to uphold, refresh, and broaden its array of accreditations and approvals. Regular inspections and audits by these bodies ensure the Group's procedures, staff qualifications, and management systems adhere to the necessary standards, rules, and regulations.

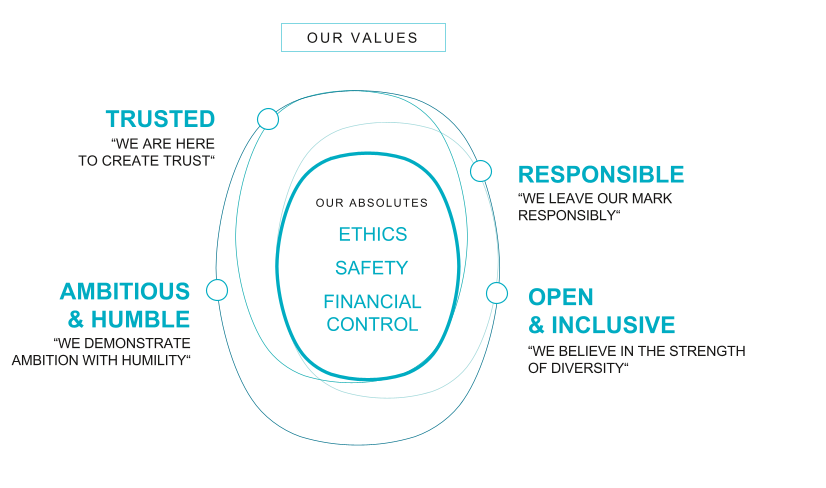

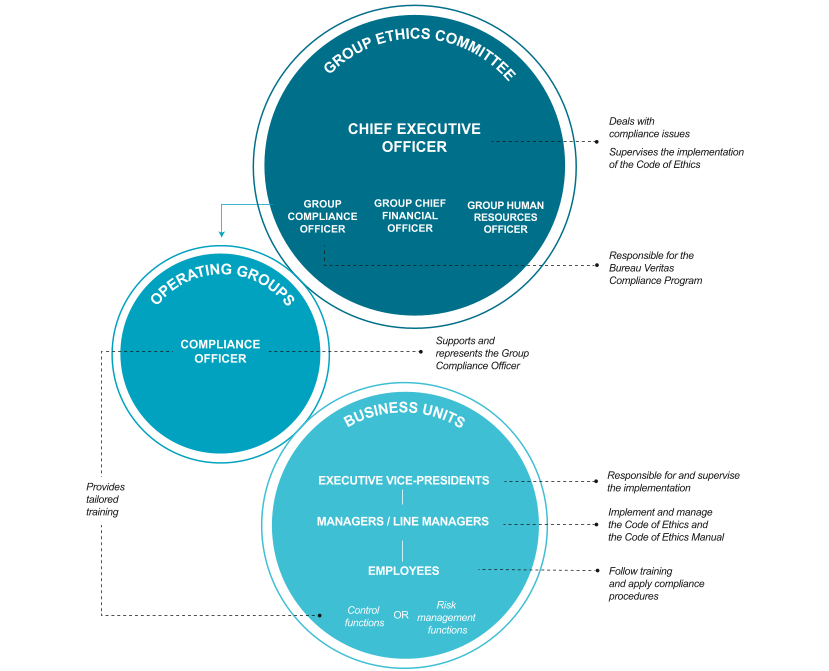

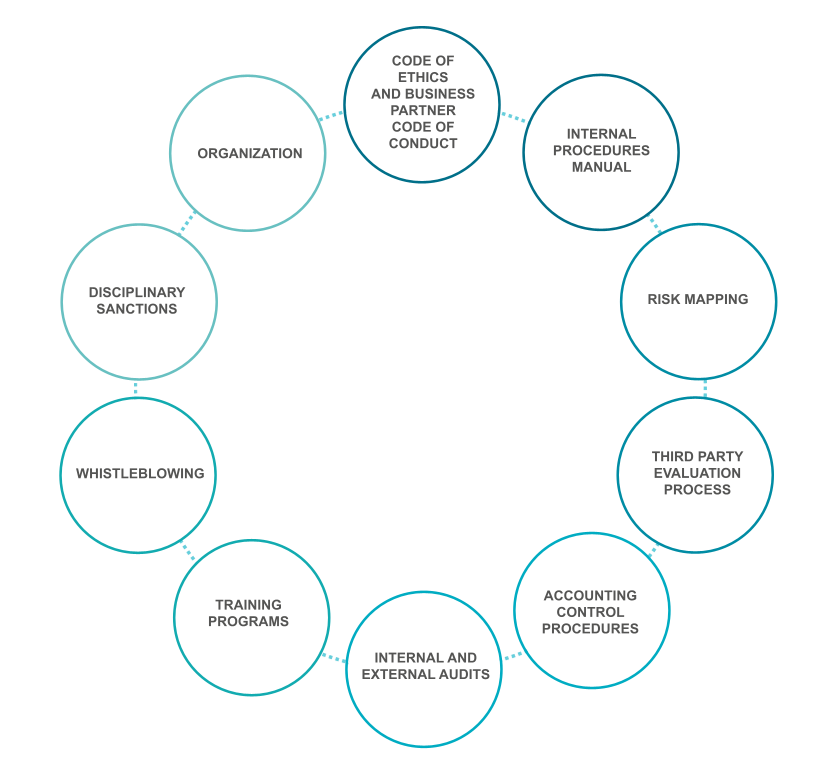

Quality and integrity embedded in the Group's culture and processes

Bureau Veritas places paramount importance on values like integrity, ethics, impartiality, and independence. These core values not only shape the brand's reputation but also enhance its value to clients. In 2003, with the guidance of the TIC Council (an international body representing independent testing, inspection, and certification firms), these values were at the heart of the efforts in the TIC profession. This collaboration culminated in the creation of the Group's inaugural Code of Ethics, released in October 2003 and regularly updated since then.

A profitable growth model supported by strong cash generation

Bureau Veritas' financial structure is built on a robust foundation that hinges on four essential characteristics:

- 1.Two major growth drivers:

- •organic growth, averaging around 4% over the last ten years;

- •strategic acquisitions.

- 2.A profitable growth model, with an adjusted operating margin of 16.0% in 2024. This demonstrates the Company's ability to effectively manage its operations and maintain profitability.

- 3.Steady available cash flow generation, averaging around €700 million over the past five years. This is due to the significant efforts deployed to monitor and optimize its cash flow and liquidity, especially when it comes to working capital requirements.

- 4.Rigorous capital allocation strategy:

- •net debt remains considerably below banking ratio thresholds;

- •the Group must have the liquidity to fund potential acquisitions and continue its commitment to pay dividends to its shareholders.

-

1.5Presentation of business activities

1.5.1Marine & Offshore

Group revenue

Group adjusted operating profit

A portfolio offering high value-added to a loyal client base

Bureau Veritas verifies that ships and offshore facilities comply with classification rules, mainly as regards the robustness and reliability of equipment. This mission is usually carried out together with the regulatory certification mission essential for operating ships. Marine insurance companies require such certificates to provide coverage, and port authorities also check that valid certificates exist when ships come into port. It is also essential for operators to make sure that their offshore facilities are in line with applicable safety and quality standards, as well as regulatory requirements.

Bureau Veritas Marine & Offshore services help clients comply with these regulations. They also help them reduce risk, extend asset lifecycles and protect the marine environment.

The Group is involved from the construction phase, approving drawings, surveying the shipyard and inspecting materials and equipment. Experts then make regular inspections throughout the vessel's lifetime to provide ongoing oversight. Bureau Veritas provides a range of technical services, including asset integrity management. On behalf of its clients, the Group monitors any changes in regulations, identifies applicable standards, and liaises with the authorities. It also informs them about the compliance process and carries out design and execution reviews.

The Group has diversified its services: first by providing loss adjustment and risk assessment for the offshore industry and later marine accident investigations, pre- and post-salvage advice and the refloating of vessels. In 2018, it created Bureau Veritas Solutions Marine & Offshore (BV Solutions M&O). In 2024, 42% of Bureau Veritas Marine & Offshore revenue was generated by the certification of ships under construction, while the remainder was generated by the surveillance of ships in service and complementary services.

Bureau Veritas is a member of the International Association of Classification Societies (IACS), which brings together the largest international classification societies. Together, these companies classify around 90% of the world's ships. The rest of the world's fleet is either classified by small companies or not classified at all.

Worldwide network

To meet the needs of its clients, the Marine & Offshore network has more than 2,500 experts in 90 countries. In addition to 19 local design approval offices located near its clients, Bureau Veritas Marine & Offshore has a network of 180 control stations staffed with qualified surveyors in the world’s largest ports. This means that inspections can be conducted on demand, without delaying the activities of ships or their owners. This global network close to clients is essential in providing Bureau Veritas Marine & Offshore clients with an agile, high-quality service.

The worldwide fleet continues to expand

Maritime trade has been on the rise since the early 2000s, except in 2020 due to the Covid-19 pandemic. In 2024, orders for new ships and renewal of the worldwide fleet gathered pace, outpacing the trends observed since 1996. Demand is mainly for LNG carriers and container ships, as orders for bulk carriers and tankers decline.

Bureau Veritas classifies a wide range of vessels

Bureau Veritas is the world leader in terms of the number of classified ships and ranks number five worldwide in terms of tonnage with a slightly greater market share in 2024. The Group has expertise in all segments of maritime transport, spanning different types of vessel including bulk carriers, oil and chemical tankers, container ships, gas carriers, passenger ships, warships and tugs. It also has expertise in offshore facilities designed for the exploration and development of coastal and deep-water oil and gas fields (fixed and floating platforms, offshore support vessels, drill ships, subsea equipment). Bureau Veritas also holds the leading position in the market for highly technical ships such as liquefied natural gas (LNG)-fueled vessels, LNG or liquefied petroleum gas carriers, and other types of specialized vessels and equipment.

Bureau Veritas supports the maritime industry in its various advances and innovations, from Arctic shipping to LNG supply chains. It also supplies new solutions and ratings to ensure on-board safety, and supports technologies ranging from alternative fuels to on-board autonomy.

A diversified and loyal client base

- ●ship owners;

- ●shipyards and shipbuilders around the world;

- ●equipment and component manufacturers;

- ●oil companies and Engineering, Procurement, Installation and Commissioning (EPIC) contractors involved in the construction and operation of offshore production units;

- ●insurance companies, P&I (Protection & Indemnity) clubs and lawyers.

Changes in the order book

Changes in the Group's in-service fleet

A changing market

A changing regulatory environment

International regulations applicable to maritime safety and environmental protection are evolving rapidly, providing classification companies with growth opportunities and momentum. These include:

- ●Reduction in greenhouse gas (GHG) emissions: with the adoption of stricter regulations under the auspices of the International Maritime Organization (IMO) and the European Union, new and existing ships must improve their energy performance. Bureau Veritas can play a crucial role in certifying compliance with the new EEXI and CII standards.

- ●The EU's "Fit for 55" package: these measures set out a roadmap for achieving the European Union's goal of reducing GHG emissions in the EU by at least 55% by 2030 as part of the European Green Deal. Bureau Veritas offers audit, inspection and certification services to help maritime companies comply with new requirements applicable as from 2024 and 2025.

- ●The Ballast Water Management (BWM) Convention adopted under the aegis of the IMO: this entered into force in 2017 and has since given classification societies a greater role in certifying ballast water management systems.

- ●Ship recycling: the Hong Kong international convention and European regulations in this area offer opportunities for inspection and certification services related to the Inventory of Hazardous Materials (IHM) on board ships, which is necessary for ship recycling and which came into force at the end of 2018 for new ships and in January 2021 for existing vessels.

- ●Regulations applicable to ships for inland navigation transporting hazardous materials: Bureau Veritas is one of three classification societies recognized by the European Union.

- ●Cyber resilience: the IACS (International Association of Classification Societies) unified requirement concerning the on-board integration of computer-based systems came into force in 2016. It has since been rounded out by new rules for cyber resilience of on-board systems and equipment.

- ●A "safety case" system for the offshore industry: this development requires the expertise of an independent body which Bureau Veritas can provide.

- ●Monitoring, Reporting and Verification (MRV) and Data Collection System (DCS): the EU and IMO have introduced regulations on the monitoring, reporting and verification of carbon dioxide emissions and on the collection of ships' fuel consumption data. These rules aim to further drive decarbonization efforts in the maritime sector, with BV M&O responsible for verifying follow-up plans and data supplied by ship owners.

- ●The Polar Code and ban on heavy fuel oil: the "Polar Code", or "IMO Guidelines for Ships Operating in Polar Waters" came into effect in January 2017. The IMO's ban on the use of heavy fuel oil in the Arctic region has also been in place since January 1, 2024.

All these factors require technical and regulatory know-how, which is at the heart of Bureau Veritas' expertise. As a classification and certification company, the Group is well positioned to help maritime companies navigate this complex and fast-changing regulatory landscape.

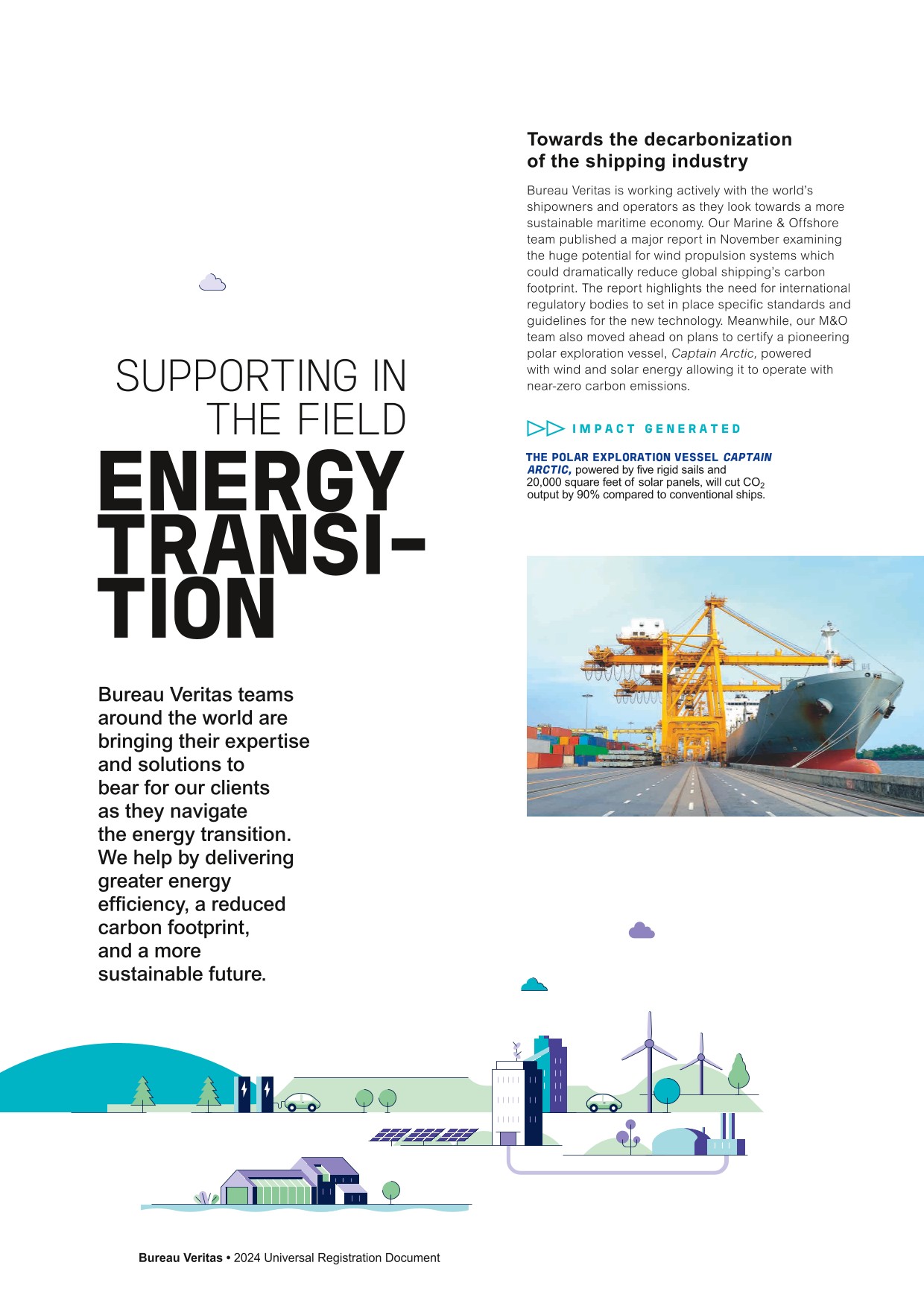

Services and solutions dedicated to the protection of the maritime environment and that meet the industry's decarbonization imperatives

The maritime sector is undergoing a deep-seated transformation, driven by the energy transition and international regulations aimed at reducing greenhouse gas emissions. This development is driving increased demand for low-carbon vessels, powered by alternative fuels (LNG, methanol, LPG) and innovative technologies such as wind propulsion and carbon capture and storage (CCUS). At the end of 2024, over half of orders for new ships were based on dual-fuel systems.

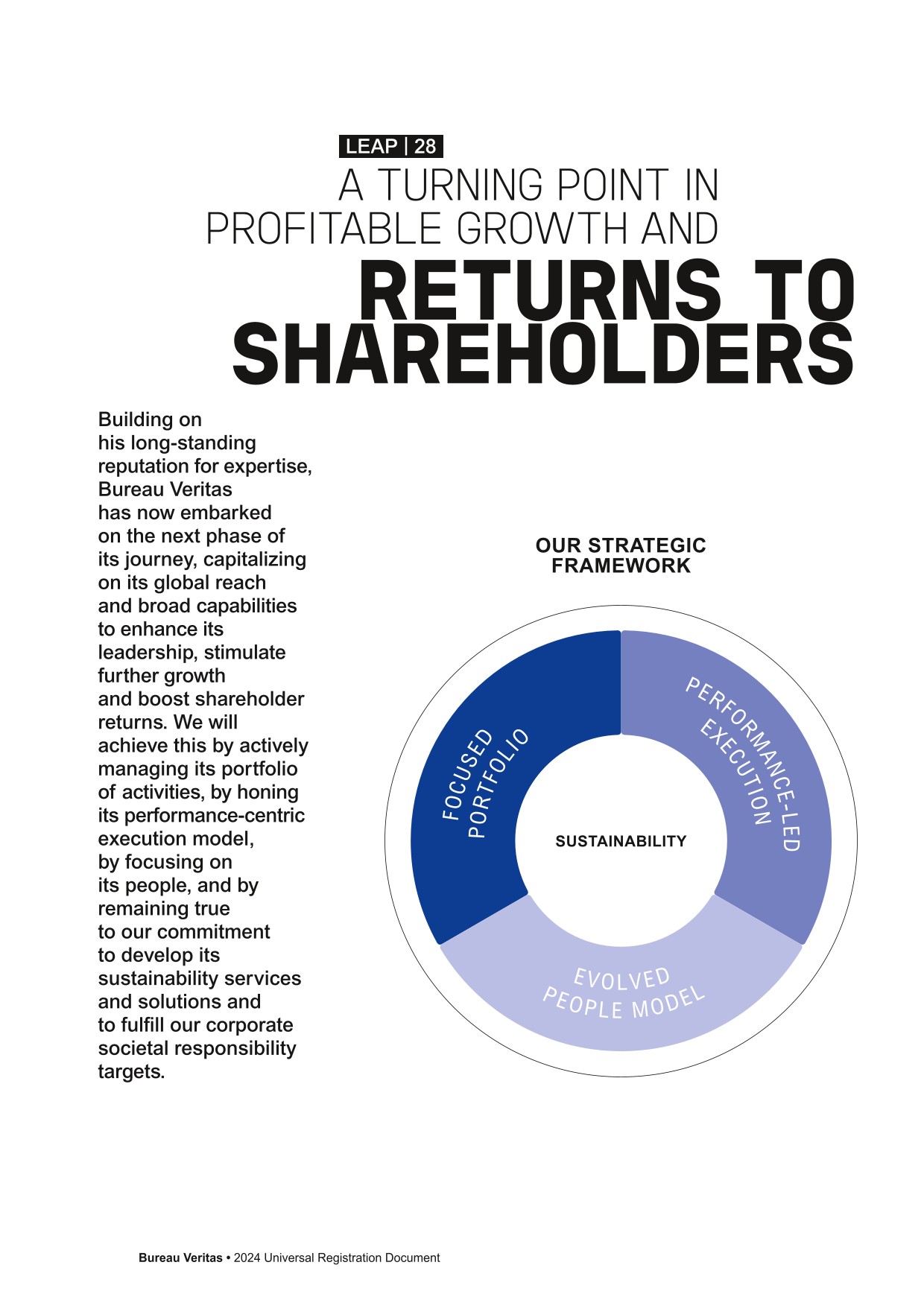

The offshore market has also seen a significant rise in investments from oil companies for both fixed and floating wind farms.

As part of its LEAP | 28 strategy, Bureau Veritas is positioning itself as a leader in the energy transition for the shipping industry. The Group helps its clients to decarbonize their fleets by promoting low-carbon solutions and supporting the adoption of innovative technologies.

With over 2,500 experts, Bureau Veritas offers recognized expertise in the classification of low-carbon ships and the certification of maritime technologies. Thanks to cutting-edge digital solutions such as digital twins, it optimizes inspections and maintenance, while reducing carbon footprint.

- ●setting standards for new fuels and technologies;

- ●developing solutions to improve operational efficiency;

- ●tracking carbon emissions and certifying environmental performance;

- ●providing consulting services for sustainable construction and crew health and safety;

- ●developing onshore and offshore wind lifecycle solutions.

This approach underscores Bureau Veritas' role as a key partner in supporting the maritime sector's transition to a more sustainable model. The Group recently published two white papers aimed at guiding and raising awareness among industry players, the first on alternative fuels (“Alternative Fuels Outlook”) and the second on the decarbonization of the shipping industry (“Decarbonization Trajectories – Sharing Expertise: Realistic Approaches to Shipping’s Decarbonization”).

Development of a higher value-added digital service offering

Efficiency is at the heart of digital classification

The digital revolution in the maritime industry is gathering momentum. Bureau Veritas Marine & Offshore is at the forefront of this revolution, optimizing the role of technology in classifying ships and offshore facilities. By leveraging new technologies, Bureau Veritas Marine & Offshore enhances its clients' experience of the classification process and helps them make safer, more efficient data-driven decisions. These technologies include digital twins, remote inspection tools such as drones, artificial intelligence, augmented reality and collaborative platforms such as Bureau Veritas MOVE.

- ●3D classification, which is bringing the design review and monitoring process for the construction of new vessels and offshore facilities into the digital age using a shared single model. By using 3D models, all affected stakeholders – design offices, shipyards and Bureau Veritas – can work together more effectively. This real-time collaborative platform improves efficiency, enabling rapid adjustments and dynamic exchanges.

- ●Remote inspection techniques, which enable certain checks to be carried out remotely on ships in operation, without an inspector on board. This gives both the client and Bureau Veritas greater flexibility, and reduces costs and travel time. Other techniques, such as drones, allow access to certain high-risk areas, improving safety for inspectors and facilitating preparation for the client.

- ●Artificial intelligence and augmented reality, which provide real-time assistance to inspectors during the inspection: for example, tools can be used to help identify points for attention, emphasize inspection points, or to provide assistance in answering technical questions.

- ●Bureau Veritas is connected to its clients' systems. For example, its BV Machinery Maintenance platform connects clients' maintenance systems with its own system, optimizing planned maintenance survey plans. Eventually, the data gathered will enable Bureau Veritas to move towards optimized, predictive inspection programs based on specific risk analyses, thus saving time and money.

Intelligent navigation is a driver of decarbonization in the shipping industry

The introduction of smart functions on board ships plays a key role in ensuring safer and more efficient operations, key drivers in the transition to a low-carbon industry.

Classification societies play an important role in facilitating the transition to this smart shipping. They help industry players to implement new automation and connectivity tools and smart functions, and to manage processes based on reliable data.

Through its SMART ratings, Bureau Veritas recognizes the importance of this transition and strives to help its clients on their path towards safer, more connected and more environmentally friendly navigation.

Bureau Veritas Marine & Offshore is aware of the need for its clients to be able to access effective digital platforms to guide them through their digitalization and decarbonization strategies. This prompted the collaboration between Bureau Veritas and OrbitMI, a maritime software company developing functionalities driven by data collected on its integration platform.

Partnering with our clients beyond the regulatory and compliance field

Developing strong value-added services remains an important growth driver for the Group and its businesses.

Bureau Veritas Solutions Marine & Offshore (BV Solutions M&O) is a separate and independent organization providing clients with specialist technical advice. In this era of energy transition, many players in the shipping industry are looking for solutions to design and operate in a more sustainable way. As an independent consultant, BV Solutions M&O offers engineering and modeling services that enable clients to evaluate and compare various solutions. This entity's international expansion, most recently in Australia and South Korea, is a response to the growing demand for these types of services.

Particularly in demand are risk and feasibility studies relating to the integration of new fuels such as hydrogen, ammonia and methanol, as well as vessel propulsion systems. These energy alternatives are at the heart of current debates on decarbonizing the shipping industry. In developing expert technical services focused on GHG strategy studies for a variety of stakeholders – from ship owners to banks – BV Solutions M&O uses a global fleet management approach and various management scenarios. These issues are crucial to the industry's ability to make informed decisions.

-

1.6Accreditations, approvals and authorizations

To conduct its business, the Group has numerous Licenses To Operate – LTO (hereafter “Authorizations”), which vary depending on the country or business concerned: accreditations, approvals, delegations of authority, official recognition, certifications or listings. These Authorizations may be issued by national governments, public or private authorities, and national or international organizations, as appropriate.

Marine & Offshore (M&O) division

The Group is a certified founding member of the International Association of Classification Societies (IACS), which brings together the 12 largest international classification societies. At European level, Bureau Veritas is a "recognized organization" under Regulation (EC) 391/2009 of the European Parliament and of the Council of April 23, 2009, setting common rules and standards for ship inspection and survey organizations. Bureau Veritas is also an accredited body under Directive 2014/90/EU of the European Parliament and of the Council of July 23, 2014 on marine equipment. Bureau Veritas currently holds more than 150 delegations of authority on behalf of national maritime authorities.

-

1.7Research and development, innovation, patents and licenses

Bureau Veritas is actively engaged in research and innovation to bolster its market positioning and explore new opportunities. The Group's major initiatives include:

- ●Technological partnerships: the Group partners with manufacturers and start-ups to jointly develop innovative solutions. These partnerships can result in the implementation of cutting-edge technologies such as artificial intelligence (AI) and blockchain. The Group launched a joint project with Amazon Web Services and Anthropic in 2024 to explore the potential of generative AI and deploy it across the Group;

- ●Strategic alliances: agreements are signed with various companies focused on specific technologies and segments. In 2023, for example, Bureau Veritas entered into a partnership with a US maritime software company (OrtbiMI) to develop joint digital solutions and facilitate their market launch. The aim is to help shipping companies in their digital transformation and decarbonization efforts;

- ●Cybersecurity: involvement in the work of the European Cyber Security Organisation underlines the importance of this issue, in line with the European Commission's objectives;

- ●Collaborative projects: involvement in projects funded by institutions such as the Single Interministerial Fund and in European calls for projects underscores the Group's commitment to large-scale initiatives. Bureau Veritas has joined CLEANHYPRO, for example. This project:

- •is a consortium of 28 partners from original equipment manufacturers (OEMs) and research and technology organizations;

- •is co-funded by the European Union, and its primary mission is to spearhead innovation in electrolysis technologies and materials. Bureau Veritas’ remit is to develop a quality label for electrolyzer stacks, offering transparency on technology and guaranteed product quality, reliability and performance. Product quality covers reliability, the effects of aging, efficiency and durability criteria.

- ●Hydrogen and renewable energies: by joining the Hydrogen Council and actively participating in ISO and CEN standardization committees, the Group is demonstrating its intention to support and shape the future of clean energies;

- ●Digitalization: Bureau Veritas is aware of the need to transition to more digital offerings and is therefore stepping up efforts to develop new concepts such as future inspection/audit services;

- ●Continuous innovation: in light of fast-paced changes in the TIC market, the Group is constantly investing to adapt and meet emerging client needs. Bureau Veritas is resolutely forward-looking, harnessing a proactive approach to research and innovation to stay at the forefront of its industry. Initiatives include:

- •development of artificial intelligence (AI) for new inspection techniques (shape recognition AI and 3D technologies) and for the use of technical rules and data (natural language-processing AI);

- •revamp of production tools to form a collaborative digital platform open to clients, leveraging product lifecycle management solutions (partnership with ARAS Innovator);

- •ongoing development of classification services to support the digitalization of maritime shipments through intelligent ratings, developed together with clients and digital solution suppliers.

-

1.8Information systems

- ●defining the Group's technological architecture. The department sets the standards for applications and infrastructure across all businesses and geographical areas;

- ●selecting and managing integrated solutions for all Group units. These solutions include messaging, collaboration tools and various systems such as ERP finance, client management, Human Resources and production;

- ●guaranteeing the availability and security of all of the Group's infrastructures and solutions;

- ●managing the Group's overall relationship with its main suppliers of equipment, software, telecommunications and services.

The department is supported by six regional centers: North America, Latin America, Europe, France/Africa, Asia, and the Middle East/Pacific. These centers provide various services to the countries in their respective regions.

A Global Shared Service Center has also been set up in India to pool certain support processes. In 2024, operating expenses and running costs for the Group's information systems represented 4% of the Group's revenue.

1)As of December 31, 2024.2)Scopes 1 and 2 greenhouse gas emissions are calculated over a 12-month period from January to December 2024. Emissions for the fourth quarter of 2024 are estimated based on figures for the fourth quarter of 2023, taking into account any major events likely to impact emissions during this period.3)TAR: Number of accidents with and without lost time x 200,000/Number of hours worked.4)Proportion of women on the Executive Committee in Band III (internal grade corresponding to a management position) in the Group (number of full-time equivalent women occupying a management position/total number of full-time equivalents occupying a management position).5)Compound Average Growth Rate.6)At constant currency.7)(Net cash generated from operating activities – lease payments + corporate tax) / adjusted operating profit. -

2.1General information

Since 1828, Bureau Veritas has acted as trust maker between companies, governments and society. It is an independent, impartial guarantor of its clients’ word.

Identity

Bureau Veritas is a world leader in laboratory testing, inspection and certification services. Created in 1828, the Group has approximately 84,000 employees located in more than 1,500 offices and laboratories across the globe. Bureau Veritas helps its clients improve their performance by offering services and innovative solutions in order to ensure that their assets, products, infrastructure and processes meet standards and regulations in terms of quality, health and safety, environmental protection and social responsibility.

-

2.2Environmental information

2.2.1Taxonomy

This Taxonomy reporting complies with Regulation (EU) No. 2020/852 of the European Parliament and of the Council of June 18, 2020 on the establishment of a framework to facilitate sustainable investment, and with Delegated Regulation (EU) No. 2021/2178 of the Commission of July 6, 2021, amended by the Delegated Regulation (EU) 2023/2486 of June 27, 2023, specifying the content and presentation of information to be disclosed.

2.2.1.1Background

The Taxonomy regulation aims to direct funding to activities that significantly contribute to one or more of the Taxonomy’s six following environmental objectives:

- ●climate change mitigation;

- ●climate change adaptation;

- ●sustainable use and protection of water and marine resources;

- ●transition to a circular economy;

- ●prevention and reduction of pollution;

- ●protection and restoration of biodiversity and ecosystems.

Delegated acts set the technical review criteria for determining the conditions under which an economic activity may claim to make a substantial contribution to one or more of the objectives of the Regulation, and for determining whether it does any significant harm to any of the other environmental objectives.

- ●they make a substantial contribution to at least one of the six environmental objectives;

- ●they do no significant harm to any of the other environmental objectives;

- ●they comply with minimum social safeguards; and

- ●they comply with the technical screening criteria set by the European Commission.

2.2.1.2Reporting methodology

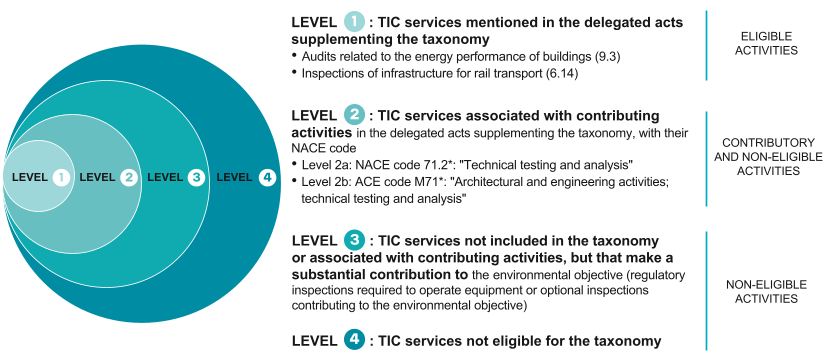

TIC Council, the professional association of compliance verification bodies, has published a guide on Taxonomy reporting for the TIC (testing, inspection, certification) sector. This guide specifies which services are Taxonomy-eligible.

- ●services eligible for the Taxonomy:

- •Level 1: TIC services explicitly mentioned in the delegated acts of the Taxonomy;

- ●services not eligible for the Taxonomy:

- •Level 2: TIC services implicitly included in Taxonomy-eligible activities;

- •Level 3: Other TIC services contributing substantially to one or more environmental objectives;

- •Level 4: TIC services that do not contribute to environmental objectives.

Eligible and/or contributory services

Ref. Economic activity

Economic activity

Eligible and/or contributory TIC services

CCA 6.13

Infrastructure for personal mobility, cycle logistics

- ●Technical inspection of personal mobility infrastructure (roads, bridges and tunnels);

- ●Safety inspection of electrical charging systems for bicycles;

- ●Inspections of electric chargers.

CCA 6.14

Infrastructure for rail transport

Services delivered to electric rail infrastructure:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Rail component and structure tests.

CCA 6.15

Infrastructure enabling road transport and public transport

Services related to road and public transport:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Material, component and structure tests.

CCA 6.16

Infrastructure for water transport

Services related to water transport:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Material, component and structure tests.

CCA 9.1

Engineering activities and related technical consultancy dedicated to climate change adaptation

- ●Technical climate change adaptation assistance;

- ●Urban planning services.

CCA 9.3

Consultancy of physical climate risk management and adaptation

- ●Climate change impact assessment;

- ●Consulting services for climate change adaptation;

- ●Consulting services for physical risk management.

CCM 6.13

Infrastructure for personal mobility, cycle logistics

- ●Technical inspection of personal mobility infrastructure (roads, bridges and tunnels);

- ●Safety inspection of electrical charging systems for bicycles;

- ●Inspections of electric chargers.

CCM 6.14

Infrastructure for rail transport

Services delivered to electric rail infrastructure:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Rail component and structure tests.

CCM 6.15

Infrastructure enabling low-carbon road transport and public transport

- ●Electrical vehicle charging station (EVCS) inspections. Electrical urban transport infrastructure control and PMA. Hydrogen fueling station inspections.

CCM 6.16

Infrastructure enabling low-carbon water transport

- ●Technical inspection of infrastructure enabling low-carbon water transport;

- ●Regulatory safety inspections of low-carbon infrastructure enabling low-carbon water transport.

CCM 7.3

Installation, maintenance, and repair of energy efficiency equipment

- ●HVAC installation/equipment periodical inspections;

- ●Technical control of energy efficiency works;

- ●Refrigerant fluid expert certification.

CCM 7.4

Installation, maintenance and repair of charging stations for electric vehicles in buildings (and parking spaces attached to buildings)

- ●According to substantial contribution (SC) criteria.

CCM 7.5

Installation, maintenance and repair of instruments and devices for measuring, regulation and controlling energy performance of buildings

- ●According to substantial contribution (SC) criteria.

CCM 7.6

Installation, maintenance, and repair of renewable energy technologies

- ●Control and inspection of wind, hot water and photovoltaic solar projects.

CCM 9.3

Professional services related to energy performance of buildings

- ●Assessment of building energy performance.

CE 3.2

Renovation of existing buildings

- ●Structural diagnosis – Asbestos inspections;

- ●Waste categorization – Safety plans.

CE 3.4

Maintenance of roads and motorways

- ●Infrastructure inspections;

- ●Maintenance surveys.

CE 3.5

Use of concrete in civil engineering

- ●Concrete testing.

PPC 2.4

Remediation of contaminated sites and area

- ●Environmental tests.

WTR 1.1

Manufacture, installation and associated services for leakage control technologies enabling leakage reduction and prevention in water supply

- ●Configuration and installation of leakage control technologies.

WTR 4.1

Providing IT/OT data-driven solutions for leakage reduction

- ●Configuration and installation of leakage control technologies.

CCA: climate change adaptation.

CCM: climate change mitigation.

CE: circular economy.

PPC: pollution prevention and control.

WTR: water and marine resources.

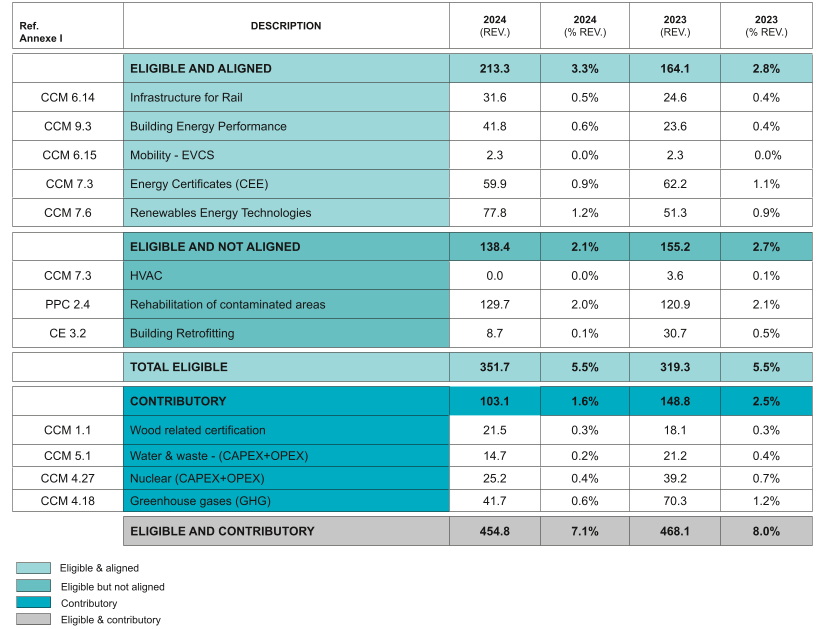

2.2.1.3Bureau Veritas 2024 reporting

The Taxonomy reporting is prepared by a Committee spanning the Finance, Operations, Systems and CSR functions. The Committee reviews and validates the reporting method used and verifies the data collected.

Bureau Veritas’ reporting complies with the recommendations of the Taxonomy Reporting Guide issued by TIC Council, the professional association of compliance auditors.

- ●the 2024 report covers the proportion of turnover, capital expenditure (CapEx) and operating expenditure (OpEx) associated with eligible/not-eligible and aligned/non-aligned activities;

- ●activities that would be eligible under both climate change mitigation and climate change adaptation are reported only under climate change mitigation, to avoid any risk of being counted twice;

- ●eligibility: only level 1 activities are reported as eligible;

- ●alignment:

- •SC (substantial contribution):

- •SC criteria are met for the activities with which TIC services are associated;

- •because of the difficulties involved in collecting SC data owing to the large number of clients concerned, only activities without SC criteria are considered aligned in this report;

- •DNSH (do no significant harm):

- •none of the reported activities do any significant harm to the other environmental objectives (Article 17 of the Taxonomy Regulation);

- •the DNSH requirements for the activities with which TIC services are associated apply only when relevant, as recommended in the European Commission FAQ of December 19, 2022;

- •the DNSH requirements listed in Annex A ("Generic criteria for DNSH to climate change mitigation") of the Delegated Act for Climate Change Mitigation apply;

- •Minimum safeguards:

- •the minimum safeguards fall into four categories;

- •human rights

- Bureau Veritas’ Human Rights Policy and the Duty of Care Report ensure that Bureau Veritas respects human rights in its operations, subsidiaries and value chain (see sections 2.3.1.2 – B – Human rights, including forced labor and child labor and 2.4.4 – Duty of Care Plan, of this Universal Registration Document);

- •corruption

- Bureau Veritas’ Code of Ethics, which undergoes regular internal and external audits, ensures that Bureau Veritas complies with anti-corruption expectations (see section 2.4.1 – Business conduct, of this Universal Registration Document);

- •tax

- Bureau Veritas ensures that its businesses comply with laws and regulations on tax evasion, and strives to conduct its business in strict compliance with applicable tax regulations (see section 2.1.2.5 – Tax evasion, of this Universal Registration Document);

- •fair competition

- Compliance with fair competition practices is covered by Bureau Veritas’ Code of Ethics, which undergoes regular internal and external audits (see section 2.4.1 – Business conduct and corporate culture, of this Universal Registration Document);

- •human rights

- •Bureau Veritas conducts its business in accordance with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight core conventions cited in the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work and the International Bill of Human Rights (Article 18 of the Taxonomy Regulation). See sections 2.1.3.1 – Strategy, business model and value chain, 2.4.1 – Business conduct and 2.3.1.2-B – Human rights, including forced labor and child labor, of this Universal Registration Document;

- •In 2024, there were no major convictions for employment law violations that called into question Bureau Veritas' compliance with the minimum safeguards.

- •the minimum safeguards fall into four categories;

- •SC (substantial contribution):

This report is presented according to the requirements of Annex 8 of the EU Taxonomy Regulation and Delegated Regulation (EU) No. 2020/852 of the Commission.

Turnover

- ●turnover is taken from the Group’s management tool (FLEX), for traceability of the amounts declared. The eligibility of each case is examined through criteria defined for three attributes:

- 1.nature of the service,

- 2.the client's market, and

- 3.the object in respect of which the service is provided.

As from 2024, the total revenue taken into account to calculate Taxonomy indicators follows the accounting principles of IFRS 15 and corresponds to "Revenue and service costs rebilled to clients".

- ●the eligibility and alignment criteria used are those defined in the TIC Council 2024 Taxonomy Guidelines.

Taxonomy-eligible and aligned Turnover by environmental objective

Share of total, eligible and aligned turnover

Proportion of total turnover

The Taxonomy reporting coverage rate increased from 80% of revenue in 2023 to 100% of revenue in 2024. This rate corresponds to the proportion of Bureau Veritas’ turnover that has the three attributes necessary to be analyzed with regard to the Taxonomy eligibility criteria in the Group’s ERP. In 2024, all Bureau Veritas turnover was analyzed.

CapEx

In 2024, capital expenditure related to assets or processes associated with economic activities that could be considered environmentally sustainable under Annexes I and II of the Taxonomy regulation include:

- ●office, laboratory and vehicle leases (IFRS 16):

- •amount of office and laboratory leases signed in 2024,

- •company vehicle leases signed in 2024.

CapEx breakdown

CapEx

2024 amount

(in €m)%

2023 amount

(in €m)%

Office or laboratory leases

108.8

21%

95.4

29%

Equipment and company vehicle leases

64.4

12%

49.9

15%

Total eligible CapEx (numerator)

173.2

33%

145.3

44%

Property, plant and equipment (land, buildings or equipment)

152.5

29%

132.9

41%

Intangible assets (software, patents, etc.)

198.1

38%

48.9

15%

Total CapEx (denominator)

523.8

100%

327.1

100%

CapEx is made available to Bureau Veritas businesses indiscriminately. As we do not have the means to quantify the proportion of aligned CapEx, Bureau Veritas considers that all of this CapEx is non-aligned.

OpEx

OpEx encompasses operating expenditure related to assets or processes associated with economic activities that could be considered environmentally sustainable, including the following:

- ●research and development for €4.9 million;

- ●short-term leases for €50.5 million;

- ●maintenance and repair of assets for €115.2 million.

OpEx breakdown

This operational expenditure accounts for less than 5% of operational costs (salaries, sub-contractors and purchasing). It is not material for Bureau Veritas' business model. Consequently, it will not be reported according to the exemption rule set out in article 1.3.1.2 of Commission delegated regulation (EU) 2021/2178 of July 6, 2021.

(in €m)

Salaries (a)

Sub-

contractors (b)Purchasing (c)

Op. costs

(a)+(b)+(c)OpEx/Op.

costs (%)2024 operational costs (Op. Costs)

2,702

632

1,311

4,645

1.2%

Turnover

Year N

2024

Substantial contribution criteria

DNSH criteria ("Does No Significant Harm") (h)

Economic activities (1)

Code(s) (2)

Turnover (3)

Proportion of turnover, year N (4)

Climate change mitigation (5)

Climate change adaptation (6)

Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change mitigation (11)

Climate change adaptation (12)

Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards (17)

Proportion of Taxonomy-aligned (A.1) or Taxonomy-eligible (A.2) turnover, year N-1 (18)

Category (enabling activity) year N-1 (19)

Category (transitional activity) (20)

€m

%

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A - Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

31.6

0.5%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.4%

M

Professional services related to energy performance of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

41.8

0.6%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.4%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

2.3

0.0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.0%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

59.9

0.9%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

1.1%

M

Installation, maintenance and repair of renewable energy technologies (Annex I – 7.6)

Inspection of renewable energy production facilities

CCM 7.6

77.8

1.2%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.9%

M

Turnover of environmentally sustainable activities (Taxonomy-aligned) (A.1)

213.3

3.3%

3.3%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

2.8%

o/w enabling

213.3

3.3%

3.3%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

2.8%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

EL

N/EL

N/EL

N/EL

N/EL

N/EL

0.1%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental tests

PPC 2.4

129.7

2.0%

N/EL

N/EL

N/EL

EL

N/EL

N/EL

2.1%

Renovation of existing buildings

(Annex II - 3.2)

Renovation of buildings

CE 3.2

8.7

0.1%

N/EL

N/EL

N/EL

N/EL

EL

N/EL

0.5%

Turnover of Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (A.1)

138.4

2.1%

0.0%

0%

0%

2.0%

0.1%

0%

2.6%

Taxonomy-eligible turnover (A.1 + A.2)

351.7

5.5%

3.2%

0.0%

0.0%

2.0%

0.1%

0.0%

5.4%

B - Taxonomy-non-eligible activities

Taxonomy non-eligible turnover

6,092.6

94.5%

Total (A + B)

6,444.3

100%

CapEx

Year N

2024

Substantial contribution criteria

DNSH criteria ("Does No Significant Harm") (h)

Economic activities (1)

Code(s) (2)

CapEx (3)

Proportion of CapEx, year N (4)

Climate change mitigation (5)

Climate change adaptation (6)

Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change mitigation (11)

Climate change adaptation (12)

Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards (17)

Proportion of

Taxonomy-aligned (A.1) or Taxonomy-eligible (A.2) CapEx, year N-1 (18)Category (enabling activity) year N-1 (19)

Category (transitional activity) (20)

€m

%

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A - Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Professional services related to energy performance of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of renewable energy technologies (Annex I-7.6)

Inspection of renewable energy production facilities

CCM 7.6

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

CapEx of environmentally sustainable activities (Taxonomy-aligned) (A.1)

0

0%

0.0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

o/w enabling

0

0%

0.0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

0

0.0%

EL

N/EL

N/EL

N/EL

N/EL

N/EL

0%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental tests

PPC 2.4

64.4

12.3%

N/EL

N/EL

N/EL

EL

N/EL

N/EL

15.3%

Renovation of existing buildings

(Annex II - 3.2)

Renovation of buildings

CE 3.2

108.8

20.8%

N/EL

N/EL

N/EL

N/EL

EL

N/EL

29.2%

CapEx of Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (A.1)

173.2

33.1%

33.1%

0%

0%

0%

0%

0%

44.4%

Taxonomy-eligible CapEx (A.1 + A.2)

173.2

33.1%

33.1%

0%

0%

0%

0%

0%

44.4%

B - Taxonomy-non-eligible activities

Taxonomy non-eligible CapEx

350.6

66.9%

Total (A + B)

523.8

100%

OpEx

Year N

2024

Substantial contribution criteria

DNSH criteria ("Does No Significant Harm") (h)

Economic activities (1)

Code(s) (2)

OpEx (3)

Proportion of OpEx, year N (4)

Climate change mitigation (5)

Climate change adaptation (6)

Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change mitigation (11)

Climate change adaptation (12)

Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards (17)

Proportion of Taxonomy-aligned (A.1) or Taxonomy-eligible (A.2) OpEx, year N-1 (18)

Category (enabling activity) year N-1 (19)

Category (transitional activity) (20)

€m

%

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

N/EL

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A - Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Professional services related to energy performance of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of renewable energy technologies (Annex I-7.6)

Inspection of renewable energy production facilities

CCM 7.6

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

OpEx of environmentally sustainable activities (Taxonomy-aligned) (A.1)

0

0%

0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

o/w enabling

0

0%

0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

0

0%

EL

N/EL

N/EL

0%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental tests

PPC 2.4

0

0%

N/EL

N/EL

N/EL

0%

Renovation of existing buildings

(Annex II - 3.2)

Renovation of buildings

CE 3.2

0

0%

N/EL

N/EL

N/EL

0%

OpEx of Taxonomy-eligible but not environmentally sustainable activities(not Taxonomy-aligned) (A.1)

0

0%

0%

0%

0%

0%

0%

Taxonomy-eligible OpEx (A.1 + A.2)

0

0%

0%

0%

0%

0%

0%

B - Taxonomy-non-eligible activities

Taxonomy non-eligible OpEx

170.6

100%

Total (A + B)

170.6

100%

-

2.3Labor-related information

2.3.1Own workforce

2.3.1.1Strategy

Interests and views of stakeholders

The interests, views and rights of the Group’s stakeholders inform the strategy and business model of Bureau Veritas through a number of priorities. These priorities help achieve a workforce for the Group that can meet the growth objectives through the creation of innovative solutions, the provision of expert advice and knowledge and the uncompromising application of ethical standards in the delivery of services to the Group’s customers. These priorities are also reflected in the Group’s human resources strategy and inform the three key components of this strategy: attract, engage, and grow.

The three components of the Group’s human resources strategy enable the execution of the strategy through policies, processes, systems and initiatives, which reflect the interests, views and rights of the Group’s workforce. These include:

- ●the provision of secure and sustainable employment;

- ●a diverse workforce and inclusive culture;

- ●on-going learning and career development;

- ●highly engaged members of the workforce;

- ●a safe workplace;

- ●the respect of human rights, including labor rights.

Material impacts, risks and opportunities and their interaction with strategy and business model

Actual and potential material impacts, risks and opportunities related to the Group’s workforce

Topic

Sub-topic

IMPACTS

RISKS

OPPORTUNITIES

Working conditions

Secure employment

An insufficiently secure job has a negative impact on employees' stable, long-term income, leading to stress and a lower standard of living. A secure job, on the other hand, gives employees a better quality of life and better mental and physical health.

An insufficiently secure job can lead to a reduced ability to attract talent, and engage and retain the workforce. This puts at risk productivity and unrealized growth opportunities.

Working conditions

Working time

The demands of the Company's activities that require long working hours may negatively impact work-life balance.

Decreased productivity and ability to attract, retain and engage talent.

Working conditions

Adequate wages

Inadequate wages could result in reputational damage, legal claims, higher labor costs, employee attrition and disengagement.

Working conditions

Social dialogue/

existence of work councils/ information, consultation and participation rights of workersFreedom of association/ Collective bargaining including the rate of workers covered by collective agreements

Too little social dialogue and collective bargaining impacts employee and local community engagement and in some cases quality of life.

Failing to foster an environment that supports workers' rights and social dialogue at Bureau Veritas poses risks of lower productivity, higher turnover, compliance issues, operational disruptions, reputational damage, and recruitment challenges.

Working conditions

Work-life balance

Demands of Bureau Veritas' business, such as irregular schedules and client site assignments, can disrupt the work-life balance of its employees, impacting their families and local communities.

A lack of work-life balance can lead to less productive employees, poorer services and less harmonious families and local communities.

Working conditions

Health & Safety

Bureau Veritas' testing and inspection activities expose its employees to health and safety risks, which the Group addresses through robust safety measures.

Neglecting health and safety can lead to legal liability, productivity declines, reputational damage, talent retention challenges, and potential loss of safety certifications required by clients.

Equal treatment and opportunities for all

Gender equality and equal pay for work of equal value

The Group' current pay practices may perpetuate gender disparities which can impact social cohesion and women’s livelihoods due to wage gaps.

Failing to address compensation disparities can lead to reputational, financial, and operational risks, such as potential non-compliance, social issues and productivity declines.

Equal treatment and opportunities for all

Training and skills development

Ensuring equitable training opportunities is necessary to ensure equal opportunities for personal, professional and career growth.

Unequal opportunities for training can lead to unrealized growth opportunities, a weaker employer brand and less ability to attract, engage and retain talent.

Equal treatment and opportunities for all

Employment and inclusion of persons with disabilities

Unsuitability of Bureau Veritas' positions or work environment for persons with disabilities, as well as under-representation in its workforce, can have negative societal impacts.

Equal treatment and opportunities for all

Measures against violence and harassment in the workplace

Insufficient internal measures taken by Bureau Veritas to address violence and harassment in the workplace could have a detrimental physical and psychological impact on its employees. This, in turn, could lead to reputational consequences for the Company's clients, partners and current/future talent.

Failure to prioritize a safe, inclusive work environment could lead to higher turnover, compliance issues, operational disruptions, reputational damage, and recruitment challenges.

Equal treatment and opportunities for all

Diversity

Insufficient focus on diversity and inclusion undermines the trust and satisfaction of employees, communities, and shareholders, as the Group fails to reflect the diversity of its stakeholders or capitalize on the benefits of a diverse workforce and inclusive culture. It also impacts the ability of more underrepresented groups to secure sustainable employment. Equal treatment and opportunities for all means a more diverse workforce and ensures that minorities have access to enriching career paths.

Neglecting diversity and inclusion can lead to reputational, performance and financial risks, such as potential non-compliance, insufficient innovation, reduced capacity to attract and retain talent, and client deselection.

Other work-related rights

Child labor and forced labor

Failing to prevent child labor and forced labor carries reputational, legal, and compliance risks that could severely undermine Bureau Veritas' ethical standards and public trust.

The frequency of significant negative work-related incidents, particularly those relating to secure employment, depends on a variety of factors, such as economic conditions, and is therefore impossible to report.

- ●the need for the Group to have a highly skilled workforce to meet the changing regulations and expectations of its customers;

- ●the competitive advantage in productivity the Group receives from having a workforce that is engaged;

- ●innovation and creativity from the Group’s workforce that it leverages to develop solutions for its customers and its own operations through a diverse workforce;

- ●a strong organizational and employer brand that the Group utilizes to attract and retain members of its workforce and its customers to meet its growth plans through an inclusive, consultative, and safe culture.

Members of the Group's workforce to whom these impacts, risks, and opportunities primarily relate are its employees and non-employees.

- ●Employees have mainly permanent contracts. Due to the specificity of certain activities, Bureau Veritas also uses fixed term, and non-guaranteed hours employment contracts.

- ●Non-employees of the Group’s workforce are not significant in number relative to employees and are not managed centrally. They provide to Bureau Veritas additional capacity when facing a peak of activity and additional expertise for specific technical requirements. These non-employees are mainly sub-contractors participating in the delivery of the Group's services. Regardless of where they provide their services, they do so under the responsibility of Bureau Veritas’ Management, and they apply Bureau Veritas’ policies and processes.

The Group currently does not consolidate central records of these non-employees. For this reason, the information provided in section 2.3.1 − Own workforce, of this Universal Registration Document relates to employees only, unless otherwise stated.

2.3.1.2Impacts, risks and opportunities management

I- Policies & Actions

The Group has designed and implemented a human resources strategy based on the guiding principle of "Safety & Well-being". This strategy is designed to manage actual and potential material impacts, risks and opportunities related to the Group’s own workforce, and is structured around three Group-wide policies: "Strategic skills", "Employee experience" and "Career growth". Its design is partly based on employee testimonials and feedback gathered through initiatives such as the annual engagement survey.

The impact of this strategy is measured by employee feedback from engagement surveys and discussions with employee representatives. Employees are informed about this strategy by Group managers and through centralized communications. The Chief People Officer is responsible for implementing the relevant policies at Group level, with the aim of completing the key actions by the end of 2028.

3 Group-wide policies

Common thread

Strategic skills

Employee experience

Career growth

Safety & Well-being

- ●Strategic talent attraction

- ●Competitive and fair compensation, with pay equity

- ●Employee feedback

- ●Inclusive culture

- ●Diversified workforce, including:

- ●Gender balance

- ●Diverse ethnic representation

- ●People with disabilities

- ●People belonging to the LGBTI+ community

- ●Cross-generational employees

- ●Military veterans

- ●First Nations people

- ●People with other family responsibilities

- ●Harassment-free working environment

- ●Respect for human rights, including issues related to forced labor and child labor

- ●Learning Strategy, Professional and Leadership Development

- ●Technical learning, vocational skills and externally recognized qualifications

- ●Onboarding

- ●Career development and internal mobility

- ●Training, communication and employee engagement

- ●Well-being

Bureau Veritas identifies necessary and appropriate actions in response to actual or potential negative impacts on its workforce, based on risk monitoring metrics for these impacts and on consultations with its employees and/or their representatives. These monitoring and consultation efforts enable Bureau Veritas to assess whether the Company's practices are having a material negative impact on its employees.

Actual and potential material impacts, risks and opportunities related to the Group’s workforce

Secure employment

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Career growth

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives on planned changes and on employees' past experiences;

- ●Remediation plans: upgrading skills and retraining employees.

- ●Career development and internal mobility

- ●Technical learning, vocational skills and externally recognized qualifications

40

Number of training hours per employee

95%

% of employees participating in a performance review

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Working time

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Employee experience

Safety & Well-being

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives on planned changes and on employees' past experiences;

- ●Remediation plans: changes to working hours and planned assignments for Group clients.

- ●Employee feedback

- ●Communication and employee engagement, training

76

0.23

Employee engagement rate

Total Accident Rate (TAR): number of accidents with and without lost time x 200,000/number of hours worked.

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Adequate wages

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Strategic skills

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives;

- ●Remediation plans: salary reviews.

- ●Competitive and fair compensation

76

Employee engagement rate

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Social dialogue/existence of works councils/information, consultation and participation rights of workers and Freedom of association/Collective bargaining, including the rate of workers covered by collective bargaining agreements

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Employee experience

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives;

- ●Remediation plans: introduction of new consultation processes.

- ●Employee feedback

- ●Respect for human rights

76

Employee engagement rate

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Work-life balance

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Employee experience

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives, discussions with groups of employee representatives specializing in safety;

- ●Remediation plans: modification of working hours and working methods.

- ●Employee feedback

- ●Well-being

76

Employee engagement rate

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

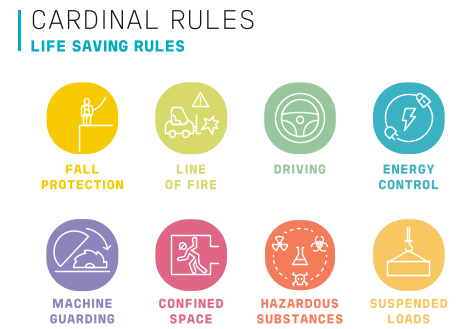

Health & Safety

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Employee experience

Safety & Well-being

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives, discussions with groups of employee representatives specializing in safety;

- ●Remediation plans: modification of working hours, working methods, working rules and work-based processes

- ●Employee feedback

- ●Cardinal Safety Rules & Safety Fundamentals

- ●Communication

- ●Training

- ●Well-being

- ●HSSE Requirements Handbook for Subcontractors and Non-Exclusive Workers

76

N/A

Employee engagement rate

Total Accident Rate (TAR): number of accidents with and without lost time x 200,000/number of hours worked.

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Gender equality and equal pay for work of equal value

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Employee experience

Strategic skills

- ●Dialogue: annual engagement survey, annual employee performance and development reviews with employee managers, consultation with employees and/or their representatives, discussions with under-represented employee groups (e.g., women at certain grades) on specific topics;

- ●Remediation plans: training for managers and employees, targeted professional development for under-represented groups, salary reviews.

- ●Gender balance

- ●Equal pay

36%

% women managers (Band EC-II)

36%

% women managers (Band EC-IV)

35%

% women in total workforce

1.0

Gender pay ratio

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Training and skills development

Policy

Dialogue process and remediation plans implemented

Action plans*

2028 goals

Metrics

Career growth

- ●Dialogue: annual engagement survey, annual reviews of employee performance and development with employee managers, consultation with employees and/or their representatives;

- ●Remediation plans: new training plans, identification of new career paths and career development opportunities.

- ●Learning Strategy, Professional and Leadership Development

- ●Technical learning, vocational skills and externally recognized qualifications

- ●Career development and internal mobility

- ●Onboarding

40

Number of training hours per employee

* Detailed descriptions of the action plans, as classified by policy, can be found following the tables relative to each topic.

Employment and inclusion of persons with disabilities

Policy

Dialogue process and remediation plans implemented